In 2024, the following five major trends will influence the insurance technology (Insurtech) industry

- AI-Powered Claims Processing and Underwriting

Artificial intelligence (AI) is still transforming the underwriting and claims process in 2024. In order to evaluate risk more quickly and accurately, insurers are using machine learning and predictive analytics, which lessens their dependency on conventional data sources like credit scores. With the use of computer vision and natural language processing (NLP) to evaluate documents, photos, and videos, AI-based claims processing is growing more effective and facilitating quicker and more precise claim approvals. This trend enhances customer satisfaction, lowers fraud, and minimizes human error.

- Expanding Embedded Insurance

The practice of seamlessly integrating insurance products into other services or transactions, known as embedded insurance, is becoming more and more popular. Insurance products should be a part of everyday purchases like travel, online shopping, and car rentals, according to consumers’ growing expectations. Insurtech startups are making it possible for “invisible” insurance to be sold at the point of need rather than through conventional channels by forming alliances with fintech firms, automakers, and e-commerce platforms. In addition to generating new sources of income, this trend opens up insurance to previously underserved markets.

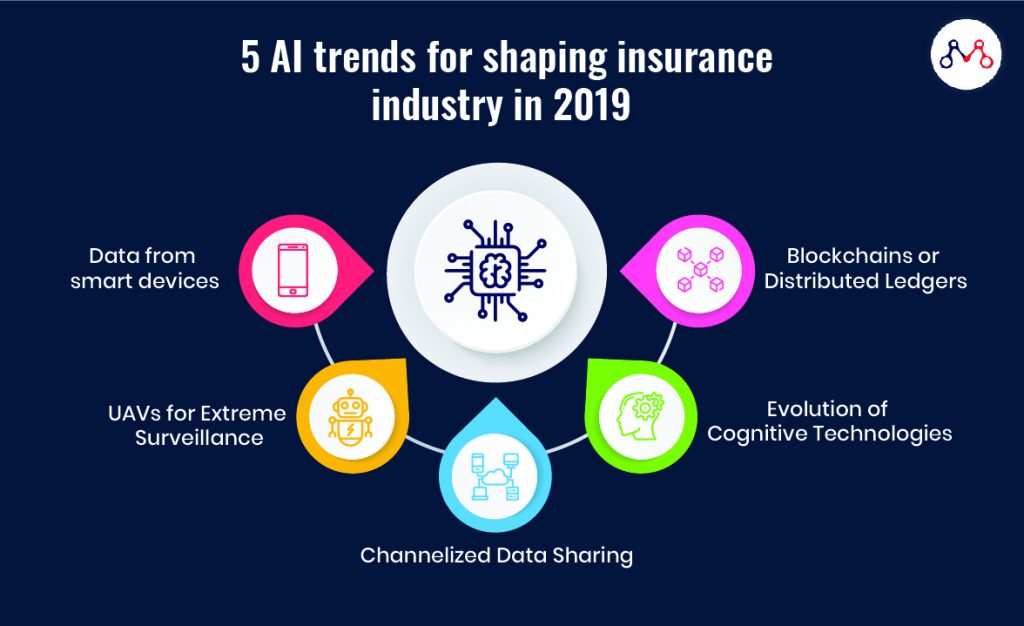

- Blockchain for Security and Transparency

Because blockchain technology offers increased security, trust, and transparency, it is making its way into the insurance industry. The use of blockchain-based smart contracts is eliminating the need for middlemen by automating the processing of insurance policies and claims when certain criteria are satisfied. Furthermore, the decentralized ledger of blockchain technology enables unchangeable record-keeping, which lowers fraud and guarantees transparency in fields like reinsurance, which frequently involve intricate layers of transactions. More insurers are implementing blockchain in 2024 in an effort to increase productivity and compliance while fostering consumer trust.

- IoT-Powered Personalized Insurance Products

Insurers are now able to provide highly customized products based on real-time data thanks to the Internet of Things (IoT). Insurers use the constant streams of data collected by devices like wearables, car telematics, and smart home systems to evaluate the risks and behaviors of specific individuals. For instance, health insurers can provide reduced rates to clients who use wearable technology to maintain healthy lifestyles, and auto insurers base their rates on telematics-monitored driving behavior. IoT is driving the increase in demand for dynamic, usage-based insurance (UBI).

- A Greater Emphasis on Cyber Insurance

The need for cyber insurance has increased dramatically as a result of the rise in digital transformation across industries. Insurtech firms are creating customized products to protect against a variety of cyberthreats, such as ransomware attacks, data breaches, and business disruptions brought on by cyber events. Comprehensive cyber insurance policies are becoming more and more in demand as companies, particularly SMEs, become more conscious of their vulnerabilities. In order to create a proactive approach to cyber risk management, insurers are integrating risk mitigation services, such as incident response and real-time threat detection, with their coverage in 2024.

With technology playing a key role in redefining the customer experience and operational efficiency, these trends demonstrate the insurance industry’s continuous shift toward digitization, personalization, and risk management.